That’s the title of a new study I conducted with Brandon McFadden and Trey Malone for the United Soybean Board through the Center for Food Demand and Sustainability. We surveyed 1,200 U.S. consumers earlier this year and asked about a variety of perceptions related to soy-based products with eye towards how consumers view soy protein and soy oil relative to the alternatives.

There’s a lot in the survey, but I’ll highlight a couple results. The first is from a conceptual mapping (or pile sorting) exercise. We asked the following question.

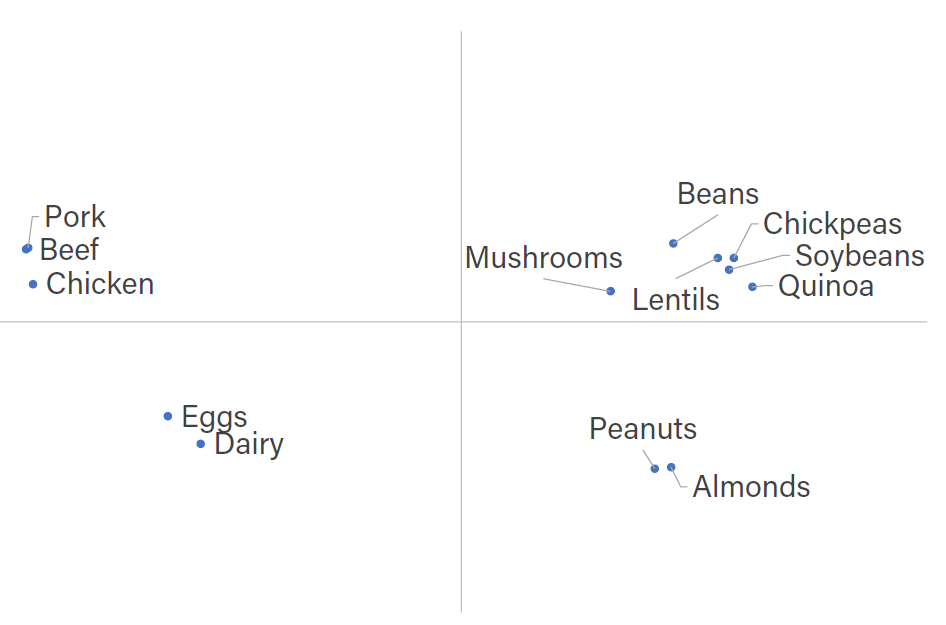

Respondents were shown a list of 13 sources of protein and they grouped them however they saw fit. We use these groupings to conduct similarity/dissimilarity analysis based on the frequency with which each food item appeared with every other food item. Limiting to two possible dimensions of perceptions, here is the resulting perceptual map.

And, here is a corresponding hierarchical cluster analysis map.

The figures show that animal-meat products group closely together and are perceived similarly. Likewise, plant-based field crops (chickpeas, lentils, and soybeans) group together. These two groupings are perceived similarly in the vertical dimension but not the horizontal one, the latter of which seems to group on animal vs. plant. Mushrooms are probably the most distinctive protein source - with the furthest distance from other groupings.

We also asked a variety of simple questions related to beliefs about taste, price, environmental impact, health, etc.

The figure above shows consumers do not rank soybeans high in perceived healthiness relative to other proteins; however, the figure below indicates soy-based protein is viewed most positively in terms of environmental friendliness.

There is a lot more in the study including questions on how people would choose among different soy-based burgers and beef/soy blends. The whole thing is available here.